How do I setup my account for eTax Receipts?

To activate your account for Canadian eTax Receipting, send an email to support@gifttool.com with:

- The name of the individual whose signature appears at the bottom of the tax receipt.

- The title of the individual whose signature appears at the bottom of the tax receipt.

- An image of their signature. You can email the signature in a Word document, or as a jpg or gif file.

- The logo to appear in the top left corner of the receipt. Send us a link to the webpage displaying your logo, or send the logo in a Word document, or as a jpg or gif file.

GiftTool will then setup your tax receipt template usually within 2 business days.

Activation fees apply. Canadian registered charities only.

Once your account has been activated for Canadian eTax receipting,

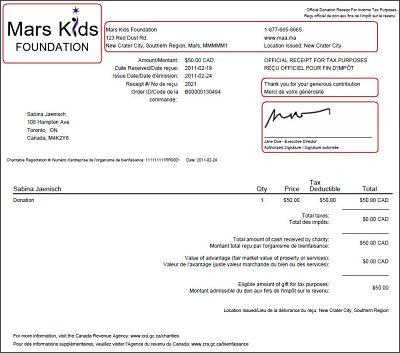

you can preview a sample eTax receipt and make any necessary changes.

- Click Donations to view the Main Menu of this

service.

- From the Canadian E-Tax Receipts section, choose Setup Receipts.

- Click Preview Receipt.

- Change the settings for the PDF document to display the

receipt at 100%. A logo image in the eTax Receipt will always

look better when viewed at 100%.

- A PDF document with a sample receipt will open in a separate

browser tab. Having

difficulty viewing the PDF document?

- When reviewing the receipt, please pay particular attention to

your official charity name, charitable registration number,

contact information, signature, and logo used.

- For further information about CRA regulations governing

charitable tax receipts, visit their website:

https://www.canada.ca/en/services/taxes/charities.html

- From the Details section of the Receipt Setup:

- Change the coordinator who will be

listed as the "From" address for all eTax receipts

issued to donors for all activities (online donations; yearly

receipts for recurring donors; donations made through the

Pledge-a-thon, Registrar or Membership service; batched receipts

issued manually).

- Uncheck the box, if you do not wish to have copies of all eTax

receipts sent to this coordinator.

- Edit the setup of the tax receipt by making changes to the

officer title and mailing address.

- If there are any changes to the logo or the signing officer's

name and signature, please send an email to support@gifttool.com with

the correct logo & signature image files (pdf or gif),

providing the proper spelling of the signing officer's name.

- Check the boxes, if you wish to have the name of the Targeted Giving Program

and/or Fund included

in all future eTax receipts. See

example with the name highlighted in red.

- Modify the Short and Long Messages on the right side of the

receipt. Short messages could include your telephone, website,

or email. Click default to automatically populate the draft

bilingual text for the Long Message, which you can change as

required.

- Click Update & Next.

If you are happy with the results in step 2, you can enter your range

of eTax receipt numbers in the Details section of the

Receipt Setup:

- Enter your receipt numbers by typing in the lowest number in your

series in the First Number field and the highest

number in your series in the Last Number field.

- eTax Receipt Numbers can be up to 16 digits long.

- Your receipt numbers must be formatted without any letters,

dashes, etc.

- The system will not accept numbers that begin with

"0". Any leading zeros will be deleted automatically.

- For current information about the CRA regulations governing

charitable tax receipts, visit their website:

https://www.canada.ca/en/services/taxes/charities.html

- You can enter as many series of numbers for the eTax receipts as

you need. Please ensure that none of the series overlap. GiftTool

will always use the lowest number available when issuing a receipt.

- Click Save.

Once you have completed this step, your account is ready to

automatically send out eTax receipts when an online donation is made.

One-Time donors will receive an eTax receipt immediately after they

make an online donation in a separate email. Recurring monthly or

quarterly donors will receive an annual eTax receipt for all donations

made throughout the year just in time for tax season.

Was this information helpful?

|

|